ADD TIME: 2021-09-14

CLICK COUNT: 815

Supply continues to deteriorate due to multiple factors, and terminal price increases are inevitable.

Entering September, many market institutions have released reports to predict the component market trend in the next quarter. Here is a view of FUSIONWORLDWIDE (FWW). The agency believes that as demand for semiconductors soars further in the third quarter, the general shortage is expected to worsen. Since the third quarter is often a period of increased production of flagship mobile phones, the supply of electronic components, especially passive components, may face additional pressure.

Review of major market changes in the second quarter

With the extended delivery time of automotive MCUs, the increase in SSD prices, and the impact on the supply of DRAM/NOR flash memory, the impact of factory fires, power outages and shutdowns encountered by some manufacturers in the first quarter of this year became apparent in the second quarter. The shortage of raw materials continued to exist in the second quarter, including wafers, silicon substrates, precious metals, and plastics.

In addition, after the surge in cryptocurrency "mining", the demand for CPU, GPU, storage, memory and ASIC has increased, resulting in a tight supply of these already scarce components. For example, DRAM prices have risen by more than 60% throughout the year, almost entirely driven by cryptocurrencies.

At the same time, due to the limited supply of IC components, another "new normal" is to restrict the production of other downstream products, causing manufacturers to give priority to products with higher return on investment. For example, due to the shortage of IC controller chips, Samsung has shifted its production focus from small-capacity SSDs to larger-capacity SSDs.

Component market outlook for the third quarter

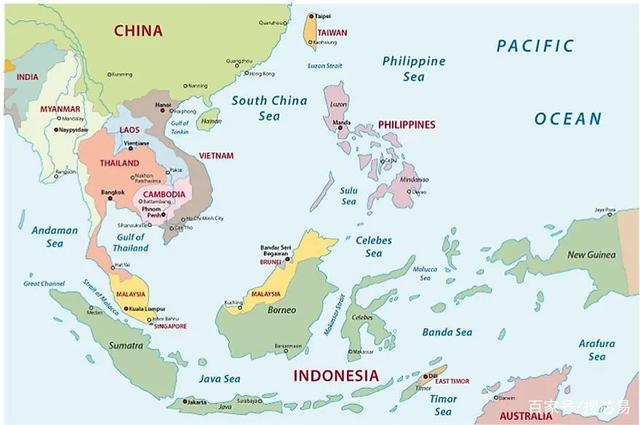

Looking ahead to this quarter, chaos such as chaotic markets and supply chain disruptions in various industries are unlikely to disappear immediately in the third quarter. The main reason behind this is that the shortage of raw materials and parts has continued for a long time, and the accumulated demand of many industries has been rising, which is difficult to digest in a short period of time. The repeated epidemics are continuously causing production interruptions or suspensions in Southeast Asia's electronics manufacturing industry.

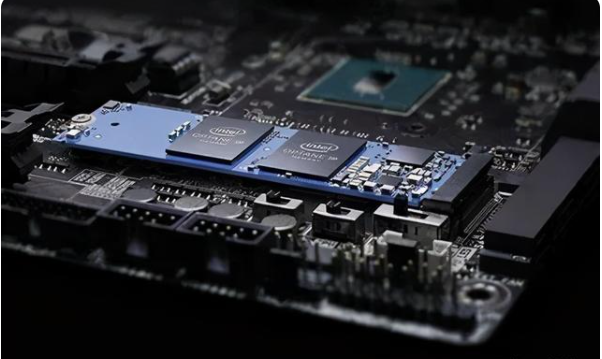

1) The shortage of SSDs is getting worse

Although this year's SSD sales started with soft and flexible pricing, the supply of SSDs has been increasingly restricted since February. The main factors causing this situation are the shortage of raw materials, natural disasters and the limited supply of its upstream controller IC.

The shortage of controller ICs has caused a bottleneck in SSD production, so the shortage in this department will continue into the third quarter. Therefore, some suppliers have begun to increase the prices of all mainstream SSD series and capacities. The pricing of mainstream brands, including Intel, Samsung and Micron, is likely to rise by 10-20% in the next quarter.

Many SSD manufacturers expect to be severely restricted for the rest of the year. For example, due to the shortage of raw materials required for production, Samsung is expected to recover from the shortage of SSDs until at least 2022. Since customers have to wait 2-3 months to receive certain SSD products, Samsung has completely stopped receiving orders for SSDs in the third quarter.

Intel's SSD supply is also affected by the shortage of key components. Compared with the second quarter, shipments in the third quarter are expected to decrease by 30-40%, and its official pricing has the potential to rise by 20%. Micron faces the same supply problem, so it is difficult to say its capacity allocation in the next quarter. At present, its most popular SSD capacities are 480G and 960G.

With the surge in 5G demand in the second half of 2021 (which is expected to grow by about 40%), the supply of SSDs may be further blocked.

2) Cryptocurrency continues to "make waves"

Throughout 2021, with the surge in cryptocurrency mining activities, currency miners around the world competed to acquire various technologies and hardware in an effort to maintain a strong market competitive position. Due to the renewed interest in cryptocurrencies in the market at the beginning of the year, additional pressure has been placed on the global supply of semiconductors, including CPUs, GPUs, storage and memory.

In the first half of 2021, GPUs will be most affected by the rise of cryptocurrency mining. The strong demand has led miners to buy products designed for gamers, such as Nvidia's RTX 3000 series. This has led Nvidia to launch new products that inhibit the "mining" function and try to improve its supply and demand problems in the coming months.

As Nvidia made changes to its graphics cards, GPU prices for all channels are now beginning to drop. At the same time, China and other countries and regions have introduced new policies that explicitly prohibit financial institutions and payment companies from providing services related to cryptocurrency transactions, which has recently hit the demand for cryptocurrencies and boosted the supply of GPUs.

Despite this, mining activities in Kazakhstan and other regions are still frequent, the availability of all RTX 30 series is still tight, and the pricing is still high. It is predicted that due to factors such as the country's support for cryptocurrency and lower energy costs, the demand for cryptocurrency mines in the region will increase.

GPU and storage manufacturers are already developing products dedicated to "mining", with durability as a key consideration. As crypto miners continue to identify and adopt more sustainable mining methods, the crypto industry may see long-term growth.

3) Production interruption in Southeast Asia

Natural disasters caused shortages of IC, CPU, and memory in the first half of 2021. As the epidemic returns, it continues to cause severe damage to various industries. Since 75% of the semiconductor manufacturing industry is located in Asia, the recent environmental disasters and shutdowns in this region may cause a chain reaction in the supply chain.

Malaysia’s major blockade since June has extended the delivery period of entry-level and mid-range logic ICs, power diodes, PCs, and power components for other applications by several weeks. More than 50 semiconductor factories will face delays and production problems, which will give rise to new price increases and supply shortages.

Infineon is facing one of the most serious shortages this year. Due to the suspension of production in Malaysia, the delivery time of its products has been extended to 26-39 weeks. Now, in addition to the 15-20% price increase planned by the company, prices may rise further. According to reports, Infineon is gradually shipping from the backlog of orders in 2020.

In addition, various regions in Southeast Asia are also facing natural disasters such as droughts, typhoons, and volcanic eruptions at any time. Once they occur, the production of a series of components may be affected, and the impact will continue throughout the season.

Summarize

With the advent of the third quarter, the global demand for semiconductors in various industries has soared, and the general shortage is expected to worsen. Since the third quarter is often a critical time point for the increase in the production of flagship mobile phones of various brands, the supply of electronic components, especially passive components, may face additional pressure.

In addition, the shortage of raw materials in the first half of the year will continue until 2021, and the shortage of ABF substrates is likely to continue until 2023. Especially SSDs will face supply constraints and price increases, mainly due to the lack of controller ICs. However, SSD is not the only component facing problems. Malaysia’s continued blockade will affect the production of a large number of ICs and delay the delivery of a large number of orders.

In addition, natural disasters in Asia may damage the production lines of many major manufacturers in the region and up to 75% of semiconductors. In addition, growing demand from industries such as encryption will exacerbate the already limited supply of GPUs and CPUs. Therefore, the FWW report believes that overall, the supply and demand problems in the first half of 2021 are expected to worsen in the third quarter.